6 Awesome Apps for Managing Your Budget

Whether you’re on iOS or Android, budgeting and personal finance apps are about as plentiful as that hoard of amassing bills hidden in your sock drawer. No better time than now to clear out that proverbial sock drawer and get your finances back on track!

Decide Which Budget App is Best for You

Often, the most important difference between budget apps is the lens they assume to help you view your personal and/or family’s finances. Everyone has different needs, so here’s a rundown of 6 popular apps with varying strategies aimed to get you back on the right track without needing a master’s degree in economics.

Goodbudget

First up is Goodbudget (iOS/Android): A consistently reliable app with minimal learning curve that utilizes an “envelope” style system of budgeting. It’s especially helpful if you find yourself juggling multiple accounts (say for example: your own, a spouse’s, and your financially irresponsible college kid’s). The $23.99 / 6 months subscription service allows for unlimited envelopes and accounts, a 5 year transaction history, and upwards of 5 devices synced “automagically”. The free plan caps you off at 10 envelopes, 1 year transaction history, and a 2 device sync limit, but that option ain’t too bad for the average bachelor on the rise toward financial stability.

(Compare to Mvelope: another solid contender in the category of envelope budgeting.)

Mint

No budget app list would be complete without mentioning that mack daddy of financial tracking services: Mint (iOS/Android/Web). Perhaps the most widely used, reviewed, and suggested app on the market for managing budgets, Mint was created by the same folks who did TurboTax and Quicken. So yeah, they’re no amateurs at saving you moolah. Like many other apps, Mint is designed to help you recognize trends in your spending, while also offering a host of other great features (such as free credit check and bill reminders).

(see also: Mint Bills (iOS/Android) for a free way to help you automate bill payments)

BillGuard

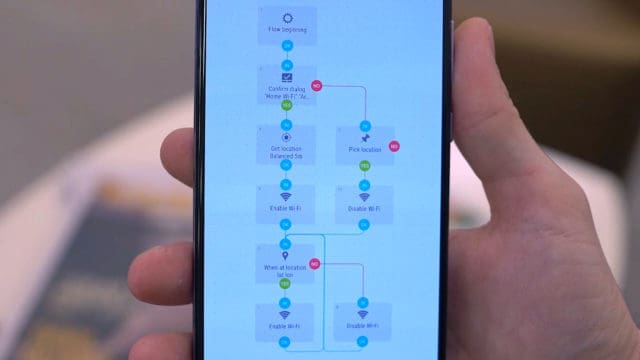

BillGuard (iOS/Android) is a no-nonsense app designed to do 2 things: track your spending, and help guard against fraud across numerous accounts. Sync up this free app to any number of credit and debit cards and watch how wonderfully BillGuard goes to work for you. They’ve adopted a Tinder-like interface of “swipe left/right” for each transaction you’ve made to determine if it really was you who purchased that $1500 Fender Strat last Saturday. But that’s not all. Want even more security? Fear not: BillGuard grants you the option to utilize your phone’s geolocation potential to alert you in the event of your cards being used away from you. Impressive… Most. Impressive.

Wallaby

Let’s assume for the moment that you’re already financially savvy enough to entrust yourself with multiple credit cards. Good job! However, if you’d really like to capitalize on your worldliness, then check out Wallaby (iOS/Android): a free app to help you determine which of your myriad credit cards to use while shopping. Theoretically, you stand to save hundreds each year by allowing Wallaby to help you navigate bonus rewards and avoid fees. Oh, and they’ll also remind you when it’s time to pay your bills.

Digit

You’ve probably been relentlessly advised your entire life to save for that aphoristic rainy day. What a drag though, amirite? Although, not yet an app for your smartphone, Digit is skillfully designed to monitor your spending habits and transparently squirrel away small amounts of money from your checking account over time (not unlike the plot to Office Space). To access the money in your Digit savings, simply send them a text message and you’ll have it back in your squandering hands by the next business day. Digit will keep you updated daily via text as to the balance of your checking account and just how much you’ve saved thus far. They’ll also send you cute gif’s of Scrooge McDuck swimming in his pool of gold.

Acorns

Another stealthy app designed to work behind the scenes of your financial life is acorns (iOS/Android). Not a bad way to dip your toes into the steamy waters of investment banking, acorns is free to download and offers to automatically save and invest small amounts of your money. The key to acorns appeal is it’s simplicity- link up your bank account and decide between 1 of 5 varying investment portfolios (ranging from conservative to aggressive). After that, you get to watch acorns track the spare change of your daily transactions and invest the ‘round-up’ amount (either automatically, or upon your approval) back into your prefered investment portfolio. Under it’s hood, acorns boasts an impressive mathematical framework that would make even Max Cohen fume with blind jealousy. The user cost is low ($1/month for investment accounts under $5k) and only kicks in after the first investment.

Most of the apps listed above are chosen on a set-and-forget philosophy: sync these apps up with your bank account and let them do all the work for you. Ideally, not having to worry about inputting data from every single receipt you collected this last month will free up your mental CPU so you can focus on those more important tasks in life…

like remembering to feed your dog 🙁

Any other quality budget apps out there worth mentioning?